Switching from stamp duty to a land tax could lead to significant savings for home buyers. Here’s what you need to know.

Switching from stamp duty to a land tax could lead to significant savings for home buyers. Here’s what you need to know.

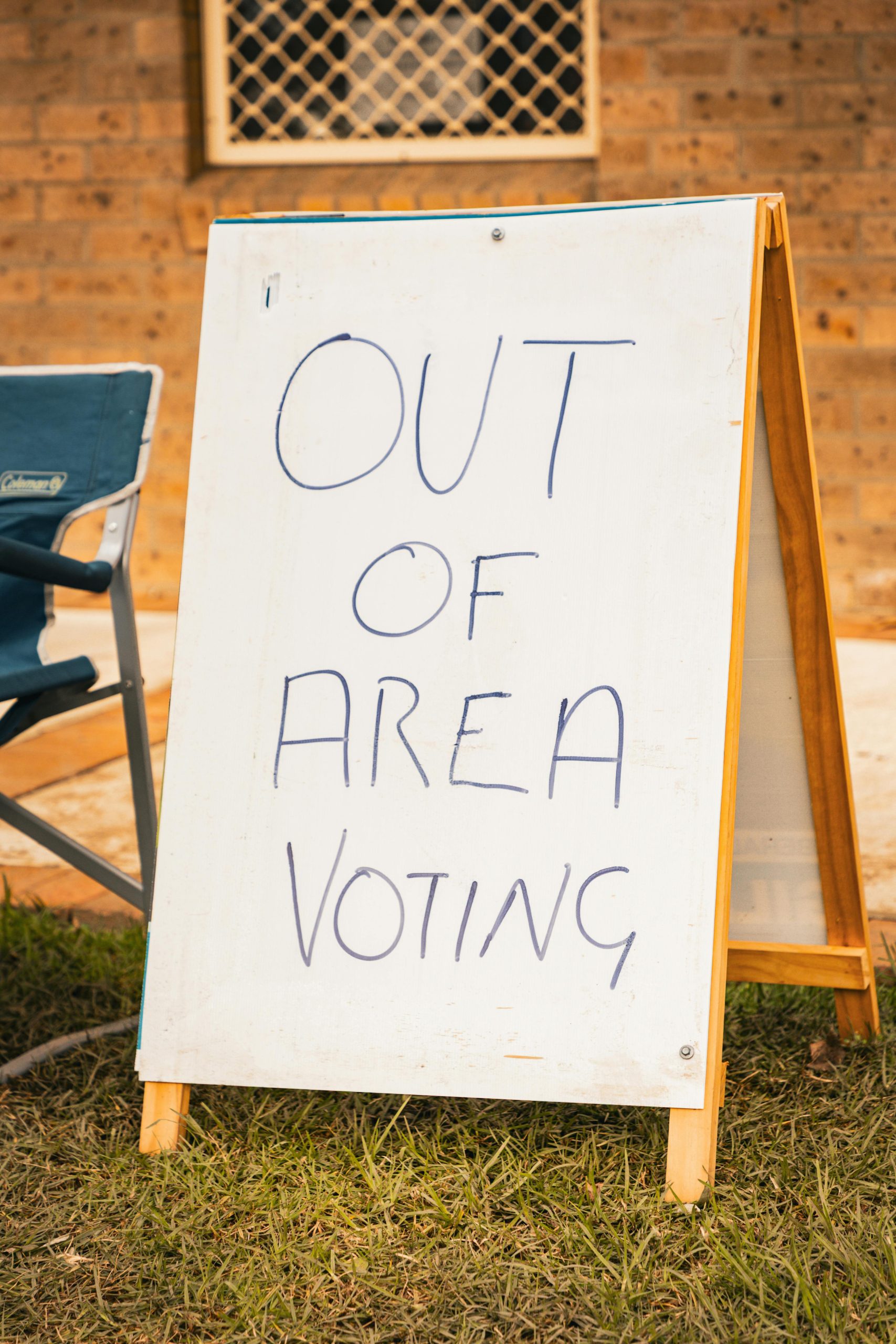

Title: The Impact of Bulk Billing and Dental Coverage on Australia’s Election: Insights from Voters As Australia approaches its upcoming election, a pivotal concern among voters has emerged: the future

Reminder: Review Your Electricity Bill! Hey everyone, just a quick heads-up! Many of you might already know this, but if you’re like me and tend to overlook your electricity bill,

We decided to take a beautiful detour and ended up in paradise! My girlfriend and I were traveling back to Melbourne from the Grampians through Horsham. Although we initially planned

Replacing stamp duty with a land tax could indeed offer significant benefits for home buyers. Stamp duty can be a hefty upfront cost, often amounting to tens of thousands of dollars, which can create barriers for first-time buyers and those looking to move up the property ladder.

By shifting to a land tax model, buyers wouldn’t have to face that immediate financial burden, making it easier to enter the market. This could also encourage more mobility in the housing market, allowing people to relocate for jobs or family without the deterrent of a steep tax hit.

Furthermore, a land tax is generally more equitable and sustainable over the long term. It could provide a steady revenue stream for governments, which can then be invested in public services and infrastructure. Unlike stamp duty, which fluctuates with property prices, a land tax would provide more predictable funding.

Additionally, reducing reliance on one-time payments could lead to better planning and development, as landowners might be incentivized to make the best use of their property rather than sitting on vacant lots to avoid taxes.

Overall, while the transition to a land tax would require careful implementation and consideration of existing homeowners, the potential savings for buyers and the broader economic impacts are certainly worth exploring.